New Year brings with it the usual optimism in me and despite having fared abysmally at my previous years’ resolutions, I have yet again made some new ones. While the world is seemingly embroiled in numerous conflicts and serious skirmishes, I still consider today’s world to be better than yesterdays. While the highlight of my parent’s generation was the cold war, I think one of the most defining and complex issues of my generation is the never-ending war in the middle-east, some of the less serious ones being TicTok and insufficient battery capacity of modern phones, but more on those later. None of these seem to even come close to what the world lost in the two world wars and numerous plagues and famines before them. So, my vote is with Steven Pinker when he argues that we are doing considerably better than our forefathers. In the same spirit, let me try and convince you that the best time to be an entrepreneur is now.

Unprecedented levels of trade between nations – A simple way to prove this is with official data. Let me start with that then.

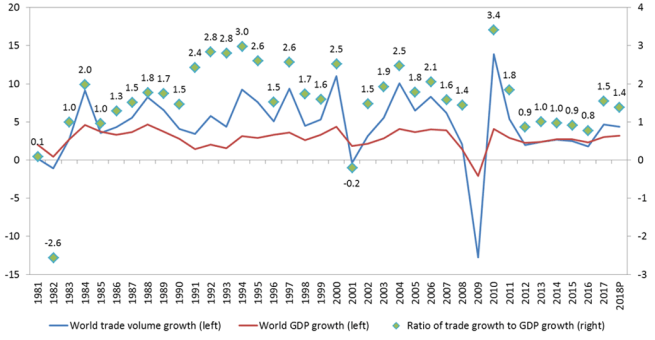

Fig. 1 percentage change and ratio

Source – WTO and UNCTAD

World trade organization’s data shows a consistent positive growth rate of world’s trade volume. As an inference, we can confidently say that since countries are exchanging goods and services more readily, there is a bigger market for anything that today’s entrepreneurs produce than there was ever available.

Maturing technology and internet services – The pace of technology development in the last decade has brought us to the point that it is possible to design and offer products and services that were only science fiction material in the late 90’s and even early 2000’s. Things like graphical computing power that enables machine learning on several hundred million training samples in a matter of days if not hours were simply unimaginable till this decade kicked in. My humble PC at home with a modest consumer AMD chip and a mid-level NVIDIA video card lets me train a deep neural network to recognize faces on thousands of training examples in 20-30 mins. It numbs my mind because my undergrad project in the late 2000s, which was trying to teach a very rudimentary neural network to read ECG waves, took us weeks and months to achieve. My conservative guess is it would now be possible in a matter of hours on a consumer device.

In addition, the improvement in technology infrastructure allows new services and products to be developed without spending valuable capital on building it yourself. With the advent of LTE technology and cloud computing infrastructure, companies do not have to buy or lease massive data centers to begin their first foray into product development. Pay as you go computing and dirt-cheap storage from giants like Microsoft, Amazon and Google let you configure the most powerful systems by clicking a few buttons on your browser. You don’t even have to worry about the security and maintenance of these systems. Talk about building on the shoulders of giants!

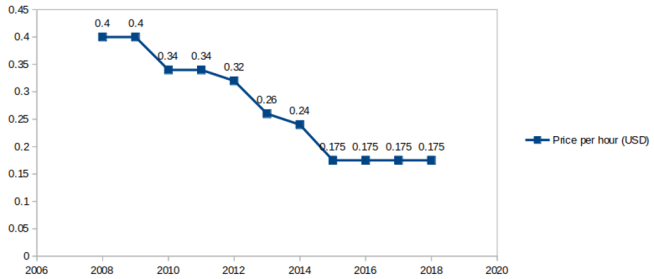

Fig 2 – AWS cost per hour for Linux on demand

Source – Internet Archives

Opportunities to Collaborate – Reaching out to the best in academia or industry has become so much simpler with professional and social networking platforms like LinkedIn, Facebook and Meetup that gone are my engineering days of where the email on an academic journal from 4 years ago is already abandoned because the contributor has moved on to a different organization or location. Collaborating with the best in any field is only a matter of intent and agreement and not a function of logistics or locating the right people for the job.

Easy and inexpensive access to Knowledge – Entrepreneurs who do not have the time to go through a formal college education or employers that do not have resources to re-skill themselves or their workforce do not have to be left out in the modern education landscape. What was ushered by platforms like Coursera has evolved and matured into a full-fledged online education scene where students and workforce can carry out parallel upgrades to their skills without disrupting their regular schedules. I am immensely thankful to such resources in helping me acquire a host of skills that would have taken me years to acquire through conventional classroom training. Looking at the business opportunity as well as a desire to keep themselves relevant in the changing education landscape, traditional universities like Harvard, Stanford, MIT and others have also started their own online courses independently or in collaboration with existing platforms to reach out to the masses. Companies like Google, IBM etc., very logically, have an incentive to market their products like Cloud Computing and AI frameworks and they have started online courses to teach anyone who would be interested. Want to learn how Google’s Cloud Platform works? Enrol in Coursera’s GCP fundamentals course where Google’s architects and engineers teach you how it works. Interested in learning about IBM’s Watson AI platform, why not try the Udemy course on developing AI solutions using Watson? Leave the tech. industry, you want to open a restaurant, this Masterclass course will let you learn from the legends like Thomas Keller, Gordon Ramsay, Dominique Ansel and several others. What is stopping you?

Access to world’s skilled workforce – With increasing immigration and growth of remote working opportunities enabled by better internet and video conferencing services, there is no reason for organizations to limit their talent search to the same state or even country. There was a belief that only companies with revenues in Billions of dollars can afford to be present in multiple countries and manage offshoring at profitable scales. However, today’s workforce is so scattered and diverse that it is possible to run an entirely organization virtually. Many small and medium scale companies are abandoning the idea of offices and only promote virtual offices with occasional get-togethers for team building reasons.

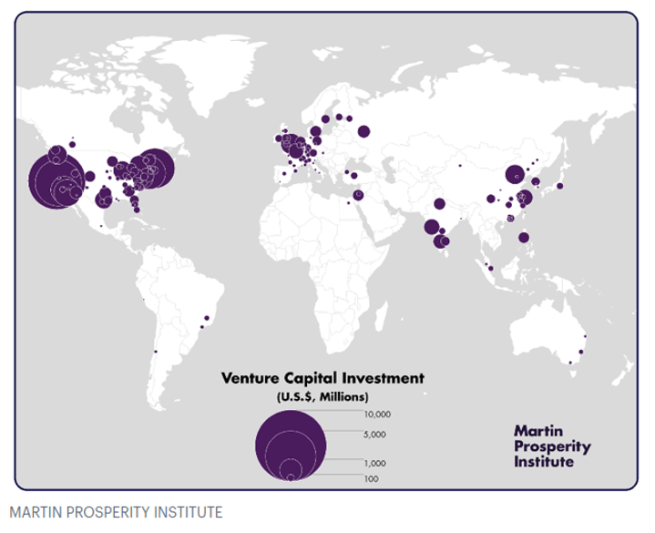

Easy Financing for Promising Ideas – Silicon Valley is no longer the only go-to place for raising money for innovative business ideas. Investors are aware of an undercurrent in several regions of the world and are paying attention to new innovation opportunities emerging from cities in China, India and Europe.

Fig.3 – growing presence of VCs around the world

Relaxing Regulatory Framework – The significant hair loss entrepreneurs suffered by the numerous regulatory hoops that they jumped through to get their companies registered within and outside their home countries is a almost a thing of the past. Many countries, in an attempt to attract global investment and to give a boost to their economies, have drastically cut the number of bureaucratic forms that new companies need to fill in order to do business. Moreover, most of these forms are available online and entrepreneurs do not need to run from one office to another to get the necessary approvals. In an attempt to kickstart a new era of growth and foreign investments, India, for example, has reduced the number of days and forms to start a new business to only 5 each and it has plans to reduce it further.

Breaking down of social barriers – Social changes take a long time to take effect but have a transcendental impact on the progress of mankind. I am happy that we have made progress, generally in the right direction. Empowering women, increasing diversity in workplace, accessibility measures for the disabled population etc. are big goals that are not yet achieved. But there is some positive movement in these directions. I am hopeful that in the coming decade, we will have more women, minorities and disabled talent will come to the surface, after breaking the virtual barriers that have been created against them over centuries.

While putting these points, my intention was not to dismiss the problems that entrepreneurs face around the world or the hurdles that they have to overcome in order to establish an enterprise. I only want to strike a positive chord for all the budding entrepreneurs and people still on the fence who harbour a dream of changing the world. If not now, when? if not you, who?